Figuring out the FAFSA finances

If it is the beginning of January and you are the parent of a high school senior, then you need to be filling out the forms and figuring out your finances. The official FAFSA form (www.fafsa.ed.gov) was made available on January 1. Since funds are distributed on a first-come, first-serve basis, even those families who don’t anticipate receiving aid are encouraged to complete the forms as early as possible.

Most colleges just use the FAFSA as their only application for need-based aid, but a variety of mostly private colleges also require families to complete the CSS profile (www.bigfuture.collegeboard.org and go to the “Pay for College” tab) so they can determine the level of institutional aid they are likely to receive.

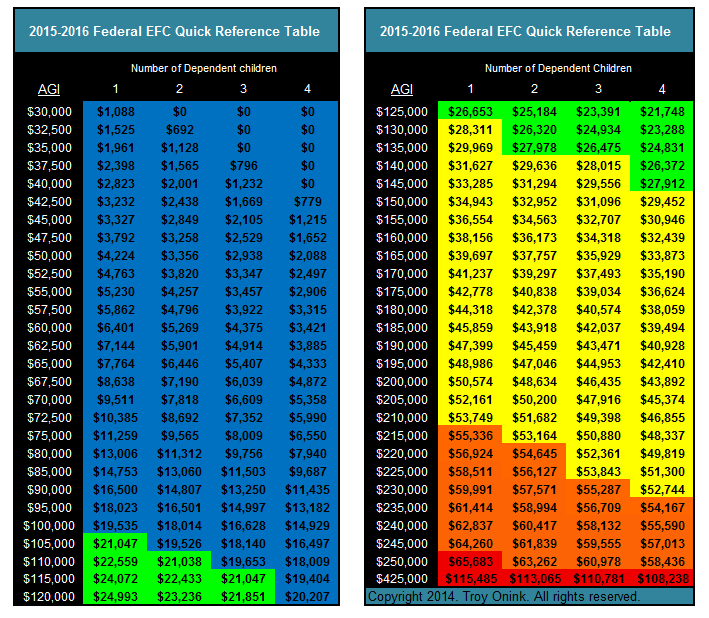

The output of both of these forms is a student’s EFC – Expected Family Contribution; this is the minimum amount that colleges will expect you can pay each year. It is not uncommon for families to look at their EFC and say “Are you crazy? We can’t afford to spend that each year.” If that is the case, then in addition to applying for need-based aid, you and your student should research and apply for merit-based aid scholarships. Check with your high school guidance office for suggestions.

If you already have one child in college, it is critically important that you complete the FAFSA each year since part of the formula recognizes the number of dependent children enrolled in college. The gist of the forms focus on the assets and income of the parents and the student as well as family size.

Colleges and universities will use the student’s EFC to determine the need for financial aid. Institutions will subtract the EFC from their total cost of attendance (this includes, tuition, room, board, fees, books, travel and personal expenses) and what is left is the amount of need-based aid for which the student qualifies. Here’s an example:

Hanna is applying to two schools: Private U and In-State Public U. The total cost of attendance at Private U is $60,000 and $25,000 at Public U. The 2014-2015 national average for a 4-year public college is $28,000, a 4-year private college is $55,000 and the 4-year elite college average price is $65,000 annually. Hanna has two other siblings and the family’s annual gross income is $110,000.

Based on this supplied information, according to the 2015-2016 Federal EFC Quick Reference Table, (www.forbes.com – type in 2015-2016 Federal EFC Quick Reference Table) the family’s estimated EFC is $19,653 which would give her a gap of over $40,000 per year at Private U and just over $5,000 per year at In-State Public U. Private U and Public U will fill some or all of that gap, that is school specific, with grants (free money), loans and work-study options.

(www.forbes.com – type in 2015-2016 Federal EFC Quick Reference Table)